Buying a house is one of the most significant decisions you'll make in life, and understanding the house buying process in Cornelius, NC, is crucial for a successful transaction. Whether you're a first-time homebuyer or an experienced one, navigating the real estate market in Cornelius can be overwhelming without proper guidance. This guide aims to simplify the process and provide you with all the necessary information to make informed decisions.

Cornelius, NC, is a vibrant town located in Mecklenburg County, just north of Charlotte. Known for its charming neighborhoods, excellent schools, and proximity to Lake Norman, it has become an attractive location for homebuyers. However, the house buying process can be complex, involving multiple steps and considerations. By the end of this article, you'll have a clear understanding of what to expect and how to approach each stage.

Our goal is to equip you with the knowledge and tools necessary to navigate the house buying process in Cornelius, NC, with confidence. From finding the right property to closing the deal, we'll cover everything you need to know. Let's dive into the details!

Read also:Paige Bj The Rising Star In The Digital Entertainment Industry

Table of Contents:

- Biography of Cornelius Real Estate

- Overview of the Cornelius Real Estate Market

- Preparing for the House Buying Process

- Finding the Right Property

- Understanding Mortgage Options

- The Offer Process

- Due Diligence and Inspections

- The Closing Process

- Tips for First-Time Homebuyers

- Common Mistakes to Avoid

Biography of Cornelius Real Estate

Cornelius, NC, has a rich history and a growing reputation as a desirable place to live. Below is a summary of key facts about Cornelius real estate:

| Fact | Details |

|---|---|

| Location | Mecklenburg County, North Carolina |

| Population | Approximately 26,000 (as of 2023) |

| Median Home Price | $450,000 (as of 2023) |

| Major Attractions | Lake Norman, Cornelius Park, and Davidson College |

| Proximity to Charlotte | Approximately 15 miles north of Charlotte |

Overview of the Cornelius Real Estate Market

The Cornelius real estate market has experienced steady growth over the years. With its proximity to Charlotte and access to Lake Norman, Cornelius offers a unique blend of suburban living with urban convenience.

Market Trends

In recent years, Cornelius has seen an increase in demand for homes, particularly in the mid-range price bracket. According to the National Association of Realtors, the median home price in Cornelius is approximately $450,000, with some luxury properties exceeding $1 million.

- Median home prices have increased by 10% annually over the past five years.

- Inventory levels remain low, creating a competitive buyer's market.

- Interest rates have fluctuated, impacting affordability for first-time buyers.

Preparing for the House Buying Process

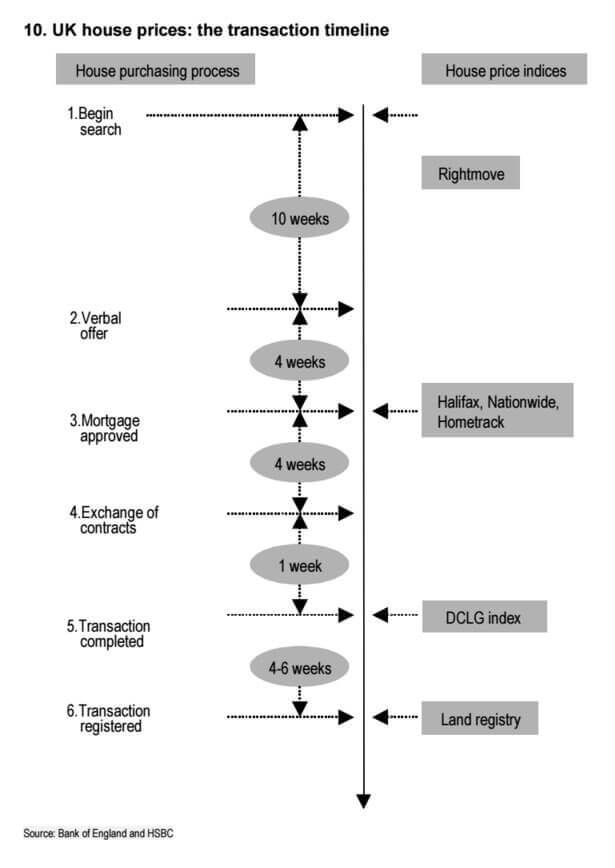

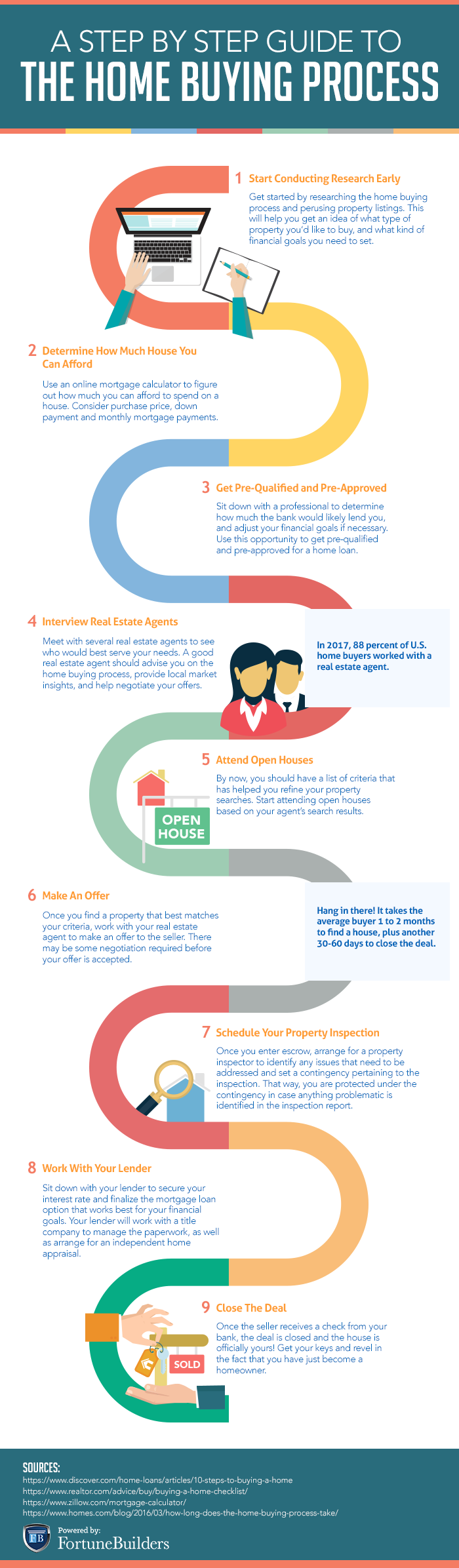

Before you begin your house buying journey, it's essential to prepare both financially and emotionally. Here's a step-by-step guide to help you get started:

Step 1: Assess Your Financial Situation

Understanding your financial situation is crucial. Begin by:

Read also:The Extraordinary Life And Influence Of Canelos Mom

- Checking your credit score

- Calculating your debt-to-income ratio

- Determining how much you can afford

Step 2: Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage gives you a clear idea of your budget and strengthens your position when making an offer. Lenders will evaluate your financial history and provide a pre-approval letter.

Finding the Right Property

Once you're financially prepared, it's time to start searching for the perfect home. Here are some tips to help you find the right property:

Research Neighborhoods

Consider the following factors when researching neighborhoods:

- Proximity to schools, shopping centers, and public transportation

- Crime rates and safety

- Community amenities and recreational activities

Understanding Mortgage Options

Choosing the right mortgage is a critical part of the house buying process. Below are some common mortgage options:

Fixed-Rate Mortgages

A fixed-rate mortgage offers a stable interest rate throughout the loan term, making it easier to budget. Most fixed-rate mortgages have terms of 15 or 30 years.

Adjustable-Rate Mortgages

An adjustable-rate mortgage (ARM) offers a lower initial interest rate that adjusts periodically based on market conditions. This option is suitable for buyers who plan to sell or refinance within a few years.

The Offer Process

Once you've found the right property, it's time to make an offer. Here's what you need to know:

Submit a Competitive Offer

Your offer should reflect the current market conditions and the property's value. Consider including contingencies, such as inspections or financing, to protect your interests.

Due Diligence and Inspections

After your offer is accepted, it's time to conduct due diligence. This involves:

Home Inspection

A professional home inspection can reveal potential issues with the property, allowing you to negotiate repairs or price adjustments.

Appraisal

An appraisal ensures the property's value aligns with the purchase price, protecting both you and the lender.

The Closing Process

The closing process is the final step in the house buying process. During this stage:

Review Closing Documents

Carefully review all closing documents, including the mortgage agreement and title insurance, to ensure everything is accurate.

Pay Closing Costs

Closing costs typically range from 2% to 5% of the purchase price and include fees for appraisal, inspection, and title insurance.

Tips for First-Time Homebuyers

First-time homebuyers may feel overwhelmed by the process. Here are some tips to help you succeed:

- Work with a reputable real estate agent

- Set realistic expectations

- Be patient and flexible during negotiations

Common Mistakes to Avoid

Here are some common mistakes to avoid during the house buying process:

- Underestimating closing costs

- Skipping the home inspection

- Not shopping around for the best mortgage rates

Kesimpulan

The house buying process in Cornelius, NC, involves several critical steps, from preparing financially to closing the deal. By following the guidance provided in this article, you can navigate the process with confidence and make informed decisions. Remember to:

- Assess your financial situation

- Work with a knowledgeable real estate agent

- Conduct thorough due diligence

Take action today by reaching out to local real estate professionals and exploring available properties. Don't forget to share this article with friends and family who may find it helpful. Happy house hunting in Cornelius, NC! For more insights into the real estate market, check out our other articles on our website.