As the world becomes increasingly digital, the Internal Revenue Service (IRS) has introduced new rules and regulations to address the taxation of digital income. Whether you're earning money through online platforms, cryptocurrency, or e-commerce, it's crucial to understand how these rules apply to your financial situation. In this comprehensive guide, we'll explore everything you need to know about the IRS digital income tax rule.

This guide aims to provide clarity on the complexities of digital income taxation. With the rise of remote work, freelancing, and digital entrepreneurship, many individuals are now earning income through digital channels. However, navigating the tax implications can be challenging without proper guidance.

By the end of this article, you'll have a clear understanding of the IRS rules governing digital income and how to ensure compliance while maximizing your financial benefits. Let's dive in!

Read also:The Ultimate Guide To Bernie Leadons Electrifying Music

Table of Contents

- Introduction to IRS Digital Income Tax Rule

- Types of Digital Income

- IRS Taxation Principles for Digital Income

- Reporting Digital Income

- Common Mistakes to Avoid

- Cryptocurrency Taxation

- Freelancing and Gig Economy

- Penalties for Non-Compliance

- Resources and Support

- Conclusion

Introduction to IRS Digital Income Tax Rule

The IRS digital income tax rule is a set of guidelines that govern how income earned through digital platforms is taxed. These rules ensure that individuals and businesses operating in the digital space comply with federal tax laws. The IRS considers digital income as taxable income, regardless of how it is earned.

Why is Digital Income Tax Important?

With the proliferation of digital earning opportunities, the IRS has recognized the need for specific regulations. These rules help prevent tax evasion and ensure fairness in the tax system. Key points include:

- Clarifying what constitutes taxable digital income.

- Providing guidelines for reporting and paying taxes.

- Offering resources for individuals and businesses to stay compliant.

Types of Digital Income

Digital income encompasses a wide range of earning methods. Understanding the different types of digital income is essential for proper tax reporting. Below are some common examples:

1. E-commerce Sales

Selling goods online through platforms like Amazon, eBay, or Etsy generates taxable income. The IRS requires sellers to report all sales revenue, minus legitimate business expenses.

2. Freelancing and Gig Work

Freelancers and gig workers earn income through platforms such as Upwork, Fiverr, or Uber. This income is subject to self-employment tax, in addition to regular income tax.

3. Cryptocurrency Gains

Cryptocurrency transactions, including buying, selling, and trading, are taxable events. The IRS treats cryptocurrency as property, meaning capital gains rules apply.

Read also:Understanding Nsfw Twitter A Comprehensive Guide

IRS Taxation Principles for Digital Income

The IRS applies general taxation principles to digital income. Here are the key principles to keep in mind:

1. Gross Income

All income, whether earned digitally or traditionally, is considered part of your gross income. This includes payments received in cash, cryptocurrency, or other forms.

2. Deductions and Credits

Individuals and businesses can deduct legitimate expenses related to earning digital income. Examples include home office expenses, software costs, and marketing expenses.

3. Self-Employment Tax

If you earn income as an independent contractor or through gig work, you may be subject to self-employment tax. This tax covers Social Security and Medicare contributions.

Reporting Digital Income

Accurate reporting of digital income is crucial for compliance with IRS regulations. Follow these steps to ensure proper reporting:

1. Gather Documentation

Collect all necessary documentation, such as 1099 forms, receipts, and transaction records. These documents will help you accurately report your income and deductions.

2. Use IRS Forms

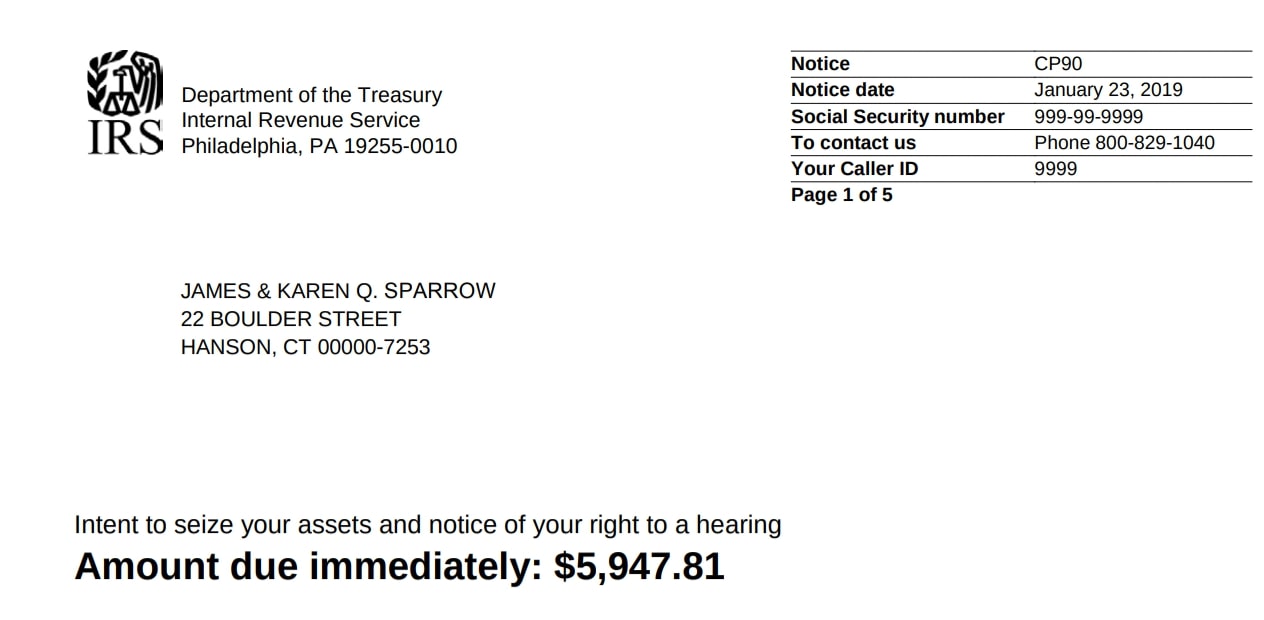

File your digital income using the appropriate IRS forms. For example, use Form 1040 for personal income and Schedule C for business expenses.

3. Seek Professional Assistance

If you're unsure about how to report your digital income, consider consulting a tax professional. They can provide guidance tailored to your specific situation.

Common Mistakes to Avoid

Misunderstanding the IRS digital income tax rule can lead to costly mistakes. Below are some common errors to avoid:

- Not reporting all sources of digital income.

- Overlooking deductions and credits.

- Failing to keep accurate records.

- Ignoring cryptocurrency transactions.

Cryptocurrency Taxation

Cryptocurrency has become a significant part of the digital economy, and the IRS has established clear guidelines for its taxation. Here's what you need to know:

1. Taxable Events

Any transaction involving cryptocurrency, such as buying, selling, or trading, is a taxable event. The IRS requires taxpayers to report these transactions on their tax returns.

2. Capital Gains

Gains or losses from cryptocurrency transactions are subject to capital gains tax. The tax rate depends on how long you held the cryptocurrency before selling or trading it.

Freelancing and Gig Economy

The rise of freelancing and gig work has brought new challenges to digital income taxation. Here are some tips for freelancers and gig workers:

1. Track Expenses

Keep detailed records of all business-related expenses. These expenses can be deducted from your taxable income, reducing your tax liability.

2. Estimate Quarterly Taxes

Freelancers and gig workers are often required to pay estimated quarterly taxes. Failure to do so can result in penalties and interest charges.

Penalties for Non-Compliance

Failing to comply with IRS digital income tax rules can result in severe penalties. These penalties may include:

- Underpayment penalties for insufficient quarterly tax payments.

- Accuracy-related penalties for underreported income.

- Failure-to-file penalties for late or missing tax returns.

Resources and Support

Several resources are available to help you navigate the IRS digital income tax rule:

1. IRS Website

The IRS website provides comprehensive information on digital income taxation, including forms, publications, and FAQs.

2. Tax Professionals

Consulting a tax professional can ensure accurate reporting and compliance with IRS regulations. They can also help you identify potential deductions and credits.

3. Online Tools

Utilize online tax preparation software and tools to simplify the process of reporting digital income. These tools often include features for tracking expenses and calculating taxes.

Conclusion

Understanding the IRS digital income tax rule is essential for anyone earning income through digital platforms. By following the guidelines outlined in this comprehensive guide, you can ensure compliance with federal tax laws while maximizing your financial benefits.

Take Action: Share your thoughts in the comments below or explore other articles on our website for more insights into personal finance and taxation. Stay informed and make the most of your digital earning opportunities!