In today's digital economy, managing finances effectively has become more important than ever. A Vanilla Visa card offers a unique solution for those looking to maintain control over their spending and simplify financial transactions. Whether you're using it for personal or business purposes, understanding how to optimize your Vanilla Visa card balance is crucial. This article will delve into everything you need to know about Vanilla Visa cards, including how to monitor balances, maximize value, and ensure security.

Prepaid cards like the Vanilla Visa card have gained popularity due to their flexibility and ease of use. Unlike traditional credit cards, prepaid cards allow users to load funds onto the card and spend only what they have available. This makes them an excellent option for budget-conscious individuals and businesses alike.

As we explore the intricacies of Vanilla Visa cards, we'll provide actionable tips and expert advice to help you make the most of your prepaid experience. From understanding key features to discovering advanced strategies for maximizing benefits, this guide aims to empower you with the knowledge you need to succeed.

Read also:Weibo Jerry Yan A Comprehensive Guide To The Stars Social Media Presence

Understanding Vanilla Visa Card Basics

What is a Vanilla Visa Card?

A Vanilla Visa card is a prepaid debit card that allows users to load funds onto the card and use it wherever Visa is accepted. Unlike traditional credit cards, there is no credit line or interest charges associated with this card. Instead, users can spend only the amount they have loaded onto the card, making it an excellent tool for budgeting and controlling expenses.

Key features of the Vanilla Visa card include:

- No credit check required

- No annual fees

- Ability to use online, in-store, or for recurring payments

- Compatibility with most ATMs worldwide

Who Can Benefit from a Vanilla Visa Card?

The Vanilla Visa card is suitable for a wide range of individuals and businesses. Some common users include:

- People without access to traditional banking services

- Individuals seeking to improve financial discipline

- Businesses looking to simplify expense management

- Travelers needing a secure way to carry funds

By offering a flexible and secure payment option, Vanilla Visa cards cater to diverse needs while maintaining affordability.

How to Check Your Vanilla Visa Card Balance

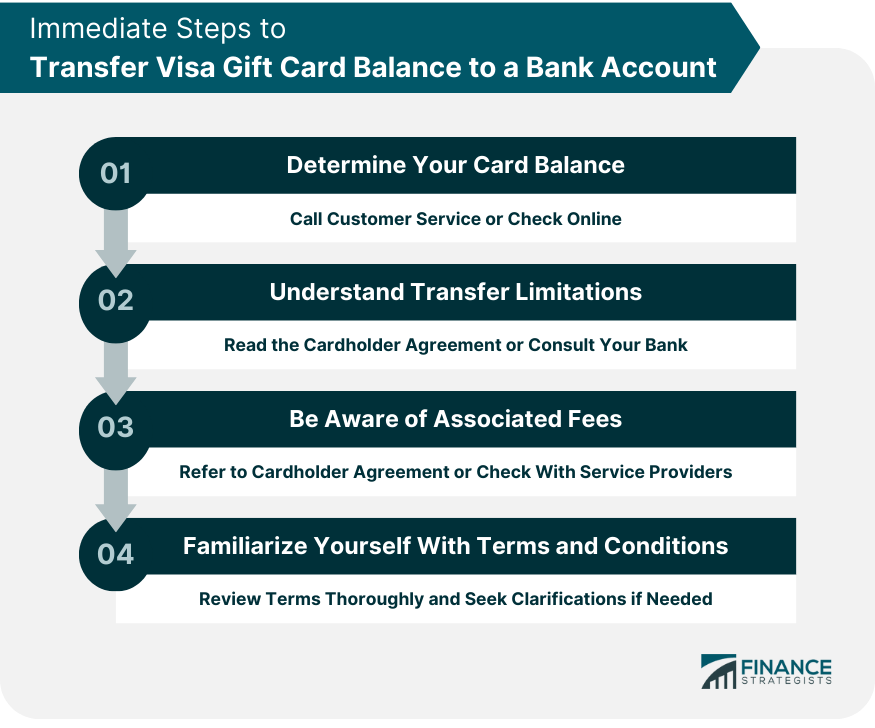

Monitoring your Vanilla Visa card balance is essential for effective financial management. There are several methods available to check your balance, each offering convenience and accessibility:

- Online Account Access: Create an account on the Vanilla Visa website to view your balance and transaction history.

- Mobile App: Download the official Vanilla Visa app for real-time updates and easy management.

- ATM Withdrawals: Use any Visa-compatible ATM to check your balance while withdrawing cash.

- Customer Service: Call the customer support number printed on the back of your card for assistance.

Regularly checking your balance ensures you stay informed about your spending habits and helps prevent unexpected overdrafts.

Read also:Exploring The Depths Of Huntsville Love And Marriage

Maximizing Your Vanilla Visa Card Balance

Strategies for Effective Fund Management

To maximize the value of your Vanilla Visa card balance, consider implementing the following strategies:

- Set clear financial goals and track progress regularly.

- Utilize the card for specific expenses, such as groceries or utility bills, to simplify budgeting.

- Take advantage of any promotional offers or reload bonuses provided by Vanilla Visa.

- Monitor transaction fees and plan accordingly to minimize costs.

By adopting these practices, you can enhance the functionality and efficiency of your Vanilla Visa card.

Exploring Additional Benefits

Beyond basic prepaid features, Vanilla Visa cards offer several additional benefits that can add value to your financial portfolio:

- Global Acceptance: Use your card wherever Visa is accepted, both domestically and internationally.

- Security Features: Enjoy fraud protection and card replacement options for added peace of mind.

- Convenience: Manage your card from anywhere using online tools and mobile apps.

These benefits make the Vanilla Visa card an attractive option for modern consumers seeking flexibility and reliability.

Security Measures for Protecting Your Balance

Protecting your Vanilla Visa card balance is crucial to prevent unauthorized access and potential fraud. Implement the following security measures to safeguard your account:

- Keep your card PIN confidential and avoid sharing it with others.

- Regularly update your account credentials and enable two-factor authentication.

- Monitor your transaction history for suspicious activity and report any discrepancies immediately.

- Use secure networks when accessing your account online or through mobile apps.

By prioritizing security, you can ensure the safety of your funds and maintain trust in your prepaid card experience.

Comparing Vanilla Visa Cards with Other Prepaid Options

While Vanilla Visa cards offer numerous advantages, it's important to compare them with other prepaid options to determine the best fit for your needs. Key factors to consider include:

- Fees and charges

- Acceptance networks

- Additional features and benefits

- Customer support availability

Researching these aspects will help you make an informed decision and select the prepaid card that aligns most closely with your financial goals.

Common Questions About Vanilla Visa Card Balances

How Often Should I Check My Balance?

It's recommended to check your Vanilla Visa card balance at least once a week to stay updated on your spending habits and ensure accuracy. Frequent monitoring can also help you identify and address any potential issues promptly.

Can I Reload My Card Online?

Yes, you can reload your Vanilla Visa card online through the official website or mobile app. This process is quick, secure, and allows you to add funds whenever needed.

Are There Any Hidden Fees?

Vanilla Visa cards are designed to be transparent, with no hidden fees. However, it's important to review the fee schedule provided by the issuer to understand any applicable charges, such as ATM withdrawal fees or international transaction fees.

Expert Tips for Managing Your Vanilla Visa Card

Managing a Vanilla Visa card effectively requires a combination of strategic planning and practical execution. Here are some expert tips to enhance your prepaid card experience:

- Set up automatic reloads for recurring expenses to streamline your financial management.

- Utilize budgeting apps or spreadsheets to track your spending and identify areas for improvement.

- Stay informed about updates and changes to Vanilla Visa policies by subscribing to their newsletter or following official channels.

By incorporating these tips into your routine, you can optimize the performance of your Vanilla Visa card and achieve greater financial success.

Real-Life Success Stories

Many Vanilla Visa card users have achieved financial stability and improved their money management skills through consistent use of the card. For example:

- A small business owner reduced operational costs by 20% after switching to Vanilla Visa for expense tracking.

- A college student successfully managed her monthly budget using the card's built-in features and monitoring tools.

- A family of four simplified their vacation planning by loading travel expenses onto a single Vanilla Visa card.

These success stories highlight the versatility and effectiveness of Vanilla Visa cards in addressing real-world financial challenges.

Future Trends in Prepaid Card Technology

As technology continues to evolve, prepaid cards like the Vanilla Visa are likely to incorporate innovative features that enhance user experience. Some anticipated trends include:

- Integration with digital wallets for seamless transactions.

- Enhanced security protocols utilizing biometric authentication.

- Expanded global acceptance networks to support international travel and commerce.

Staying informed about these developments will allow you to take full advantage of the latest advancements in prepaid card technology.

Conclusion

In conclusion, understanding and maximizing your Vanilla Visa card balance is essential for achieving financial success in today's economy. By following the strategies and tips outlined in this guide, you can effectively manage your prepaid card and enjoy its numerous benefits. Remember to prioritize security, monitor your balance regularly, and explore additional features that enhance your user experience.

We encourage you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our website for more insights into personal finance and prepaid card management. Together, let's build a brighter financial future!

Table of Contents

- Understanding Vanilla Visa Card Basics

- What is a Vanilla Visa Card?

- Who Can Benefit from a Vanilla Visa Card?

- How to Check Your Vanilla Visa Card Balance

- Maximizing Your Vanilla Visa Card Balance

- Strategies for Effective Fund Management

- Exploring Additional Benefits

- Security Measures for Protecting Your Balance

- Comparing Vanilla Visa Cards with Other Prepaid Options

- Common Questions About Vanilla Visa Card Balances