When it comes to secure online transactions, understanding the role of CVV on American Express cards is essential. CVV, or Card Verification Value, serves as an additional layer of security to protect your financial information during purchases. Whether you're shopping online or making reservations, CVV plays a crucial role in verifying the authenticity of your credit card details.

In today's digital age, online transactions have become an integral part of daily life. From booking flights to purchasing goods, the convenience of online shopping is undeniable. However, with this convenience comes the responsibility to ensure the security of your financial information. This is where CVV on American Express comes into play.

Throughout this article, we will delve into the intricacy of CVV, its importance, and how it works specifically with American Express cards. By the end of this guide, you will have a clear understanding of CVV and its role in safeguarding your financial transactions.

Read also:Unlocking The Secrets Of Acubi Dti A Comprehensive Guide

Table of Contents

- What is CVV?

- CVV on American Express

- Importance of CVV in Transactions

- How CVV Works

- Types of CVV Codes

- Security Features of CVV

- Common Questions About CVV

- Risks and Precautions with CVV

- CVV in Online Transactions

- Conclusion and Final Thoughts

What is CVV?

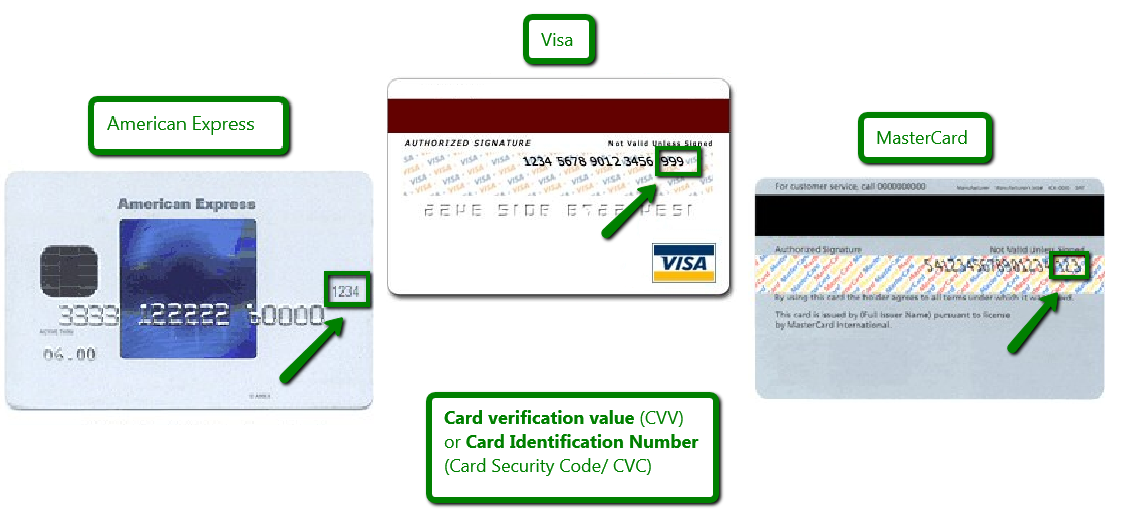

The Card Verification Value (CVV) is a three or four-digit code located on your credit or debit card. It acts as a security feature designed to prevent fraud during card-not-present transactions, such as online purchases or phone orders. This code is not stored in the magnetic stripe or chip of the card, making it an essential tool for verifying that the cardholder has the physical card during transactions.

In essence, CVV helps merchants confirm the legitimacy of the cardholder, reducing the risk of unauthorized transactions. Understanding what CVV is and how it functions is crucial for safeguarding your financial information.

CVV on American Express

Locating CVV on American Express Cards

American Express cards use a four-digit CVV code, which is distinct from the three-digit codes used by Visa and Mastercard. This code is typically found on the front of the card, above the card number. Unlike other cards where CVV is located on the back, American Express places it on the front for easy identification.

This unique placement ensures that users are aware of the difference when providing card details during transactions. Familiarizing yourself with where to find the CVV on your American Express card is essential for smooth and secure transactions.

Importance of CVV in Transactions

CVV plays a pivotal role in ensuring the security of your financial transactions. By requiring merchants to verify the CVV code, the risk of fraudulent activity is significantly reduced. This is particularly important in card-not-present transactions, where the physical card is not used.

Moreover, CVV helps protect both consumers and merchants by verifying the authenticity of the cardholder. This reduces the likelihood of chargebacks and disputes, creating a more secure and reliable transaction process.

Read also:Vinessa Vidotto Measurements A Fascinating Insight Into Her Life And Career

How CVV Works

Verification Process

When you enter your CVV during an online transaction, the merchant sends this information to the card issuer for verification. The issuer checks the CVV against the card's records to ensure it matches. If the CVV is correct, the transaction proceeds; if not, it is declined.

This process happens in real-time, ensuring that only authorized transactions are approved. The CVV code is never stored by the merchant, adding an extra layer of security to the transaction process.

Types of CVV Codes

CVV1 and CVV2

There are two types of CVV codes: CVV1 and CVV2. CVV1 is embedded in the magnetic stripe of the card and is used for in-person transactions. CVV2, on the other hand, is the code printed on the card and is used for card-not-present transactions.

American Express cards use a similar system, with the four-digit code serving as the equivalent of CVV2. Understanding the difference between these codes is important for ensuring secure transactions across various platforms.

Security Features of CVV

Advanced Fraud Prevention

CVV codes are generated using complex algorithms that make them difficult to counterfeit. This ensures that even if a card's magnetic stripe or chip is compromised, the CVV remains secure. Additionally, CVV codes are never stored by merchants, reducing the risk of data breaches.

For American Express cardholders, the four-digit CVV adds an extra layer of security, as it is not stored in the card's magnetic stripe or chip. This makes it more challenging for fraudsters to replicate or misuse card information.

Common Questions About CVV

Where is the CVV Located?

- For Visa and Mastercard: On the back of the card, usually after the last four digits of the card number.

- For American Express: On the front of the card, above the card number.

Can CVV Be Changed?

Yes, CVV codes can be changed if you suspect your card has been compromised. Contact your card issuer to request a new CVV code or a replacement card.

Risks and Precautions with CVV

Protecting Your CVV

While CVV adds a layer of security, it is not foolproof. To protect your CVV, never share it with anyone, and be cautious when entering it online. Use secure websites with HTTPS encryption to ensure your data is transmitted safely.

American Express cardholders should be particularly vigilant, as the four-digit CVV is unique to their cards and more valuable to fraudsters. Regularly monitoring your account for unauthorized transactions is also recommended.

CVV in Online Transactions

Best Practices for Secure Transactions

When shopping online, always ensure the website is legitimate and uses HTTPS encryption. Avoid entering your CVV on public Wi-Fi networks, as these can be vulnerable to hacking. Use strong passwords and two-factor authentication for added security.

For American Express users, consider enabling alerts for all transactions to stay informed of any suspicious activity. This proactive approach helps prevent fraud and ensures your financial information remains secure.

Conclusion and Final Thoughts

Understanding the role of CVV on American Express cards is crucial for ensuring secure transactions in today's digital world. By familiarizing yourself with how CVV works and implementing best practices for its use, you can protect your financial information and reduce the risk of fraud.

We encourage you to share this article with others and leave a comment below if you have any questions or insights. For more information on financial security and online transactions, explore our other articles and resources. Stay safe and informed!

![American Express CID (CVV) Code Guide [2022] UponArriving](https://i0.wp.com/uponarriving.com/wp-content/uploads/2021/03/Platinum-Card-CID.jpg)