In the world of automotive financing, subprime auto lending has emerged as a crucial financial avenue for individuals with less-than-perfect credit scores. This lending option provides access to vehicle financing for people who might otherwise be denied loans. However, it comes with its own set of challenges and risks that must be carefully navigated. If you're considering subprime auto lending, understanding its intricacies is essential.

As the global economy continues to evolve, subprime lending has become an increasingly important part of the financial landscape. It offers opportunities for people with poor credit histories to secure loans, but it also demands a higher level of financial literacy to manage the associated risks effectively.

Throughout this article, we'll delve into the nuances of subprime auto lending, explore its benefits and drawbacks, and provide actionable insights to help you make informed decisions. Whether you're a borrower or a lender, this guide will equip you with the knowledge you need to navigate this complex financial terrain.

Read also:Toongod The Rising Star In The Digital Age

Table of Contents

- What is Subprime Auto Lending?

- The History of Subprime Lending

- Key Players in Subprime Auto Lending

- Benefits of Subprime Auto Lending

- Risks Associated with Subprime Auto Lending

- How Subprime Auto Lending Works

- Understanding Interest Rates

- Tips for Borrowers

- Regulatory Landscape

- Future of Subprime Auto Lending

What is Subprime Auto Lending?

Subprime auto lending refers to the practice of extending car loans to individuals with subprime credit scores. These borrowers typically have credit scores below 620, making them higher-risk candidates for traditional loans. Lenders offering subprime auto loans often charge higher interest rates to compensate for the increased risk of default.

Subprime auto lending is a critical component of the automotive finance industry, enabling millions of consumers to purchase vehicles they might not otherwise qualify for. However, it requires careful consideration and financial planning to ensure long-term sustainability.

Who Qualifies for Subprime Auto Loans?

- Individuals with credit scores below 620

- People with a history of missed payments or bankruptcies

- Borrowers with limited credit history

The History of Subprime Lending

The origins of subprime lending can be traced back to the late 20th century when financial institutions began offering loans to higher-risk borrowers. The subprime mortgage crisis of 2008 brought widespread attention to the risks associated with subprime lending, but it also highlighted the importance of responsible lending practices.

Today, subprime auto lending has evolved significantly, with stricter regulations and more transparent practices. However, the lessons learned from past crises continue to shape the industry's approach to risk management and borrower protection.

Key Players in Subprime Auto Lending

Several key players are involved in the subprime auto lending ecosystem, each playing a vital role in the process:

- Lenders: Financial institutions specializing in subprime loans.

- Dealerships: Car dealers who facilitate the loan application process.

- Brokers: Intermediaries who connect borrowers with lenders.

Understanding the roles of these stakeholders is essential for navigating the subprime auto lending landscape effectively.

Read also:Paige Bj The Rising Star In The Digital Entertainment Industry

Benefits of Subprime Auto Lending

Despite its challenges, subprime auto lending offers several benefits to both borrowers and lenders:

- Access to Financing: Enables individuals with poor credit to purchase vehicles.

- Credit Repair: Provides an opportunity for borrowers to rebuild their credit scores.

- Profit Potential: Offers lenders higher returns due to higher interest rates.

These benefits underscore the importance of subprime auto lending in the broader financial ecosystem.

Risks Associated with Subprime Auto Lending

While subprime auto lending has its advantages, it also comes with significant risks:

- High Interest Rates: Borrowers often face exorbitant interest rates.

- Default Risk: Lenders face a higher likelihood of loan defaults.

- Financial Strain: Borrowers may struggle to meet monthly payments.

Managing these risks requires a proactive approach from both borrowers and lenders.

How to Mitigate Risks

Borrowers can reduce risks by:

- Shopping around for competitive rates.

- Building a solid repayment plan.

- Improving credit scores over time.

How Subprime Auto Lending Works

The process of subprime auto lending involves several steps:

- Application: Borrowers submit a loan application to a lender or dealership.

- Credit Check: Lenders assess the borrower's creditworthiness.

- Approval: If approved, the lender provides a loan offer.

- Repayment: Borrowers repay the loan over an agreed-upon term.

This structured process ensures transparency and accountability for all parties involved.

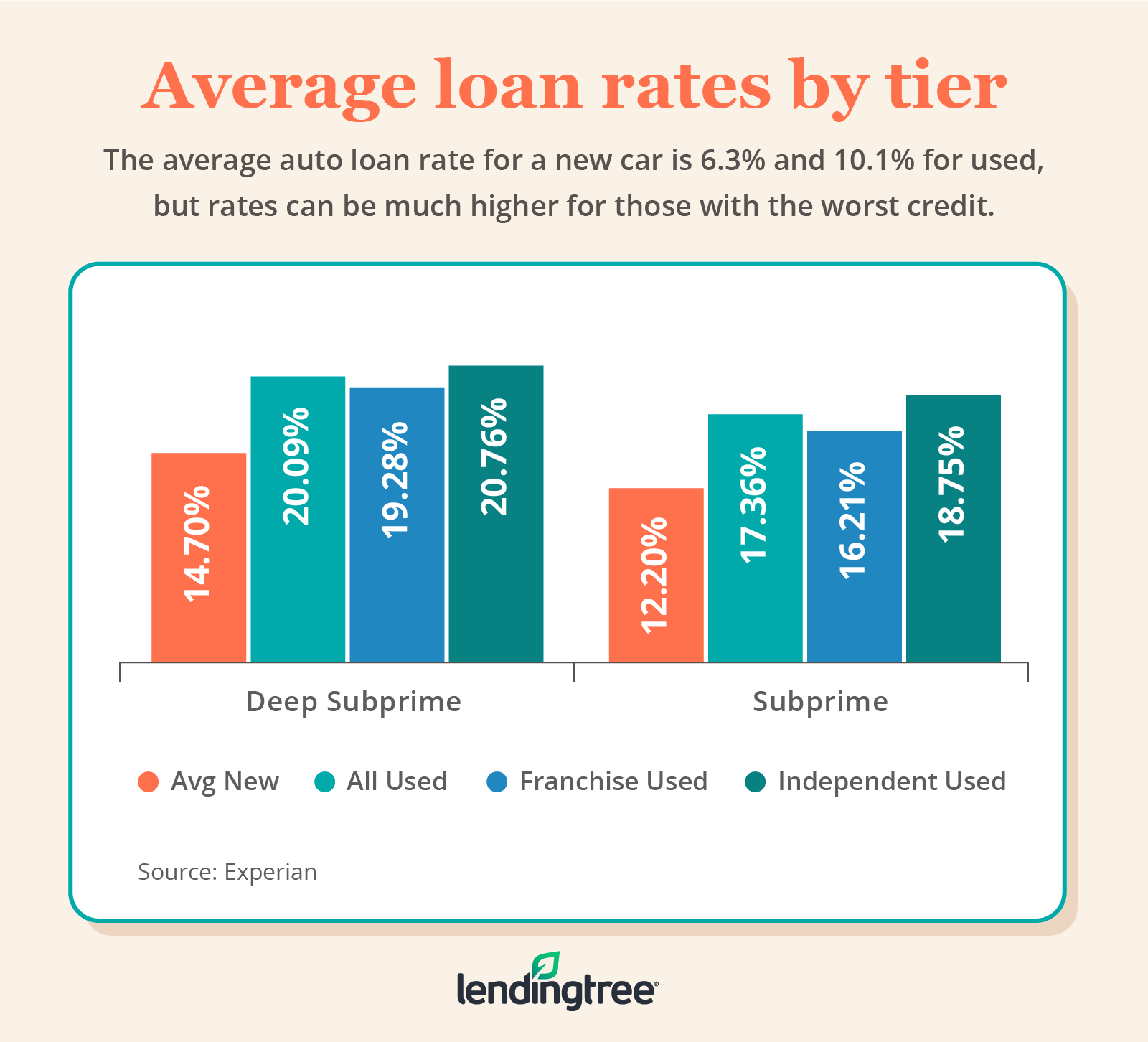

Understanding Interest Rates

Interest rates in subprime auto lending are influenced by several factors:

- Credit Score: Lower credit scores typically result in higher interest rates.

- Loan Term: Longer loan terms often lead to higher interest costs.

- Market Conditions: Economic trends can impact interest rates.

Staying informed about these factors can help borrowers secure more favorable loan terms.

Comparing Interest Rates

It's crucial for borrowers to compare interest rates from multiple lenders. According to a study by the Federal Reserve, borrowers who shop around for loans save an average of 2-3% on interest rates.

Tips for Borrowers

To make the most of subprime auto lending, borrowers should:

- Research lenders thoroughly.

- Understand all terms and conditions before signing.

- Focus on improving credit scores over time.

By following these tips, borrowers can minimize risks and maximize benefits.

Regulatory Landscape

The subprime auto lending industry is subject to strict regulations designed to protect consumers. Key regulatory bodies, such as the Consumer Financial Protection Bureau (CFPB), ensure that lenders adhere to fair lending practices. These regulations help prevent predatory lending and promote transparency in the industry.

Recent Regulatory Developments

In recent years, there have been significant regulatory changes aimed at enhancing borrower protections. For instance, the CFPB has introduced new guidelines to ensure lenders provide clear disclosures about loan terms and fees.

Future of Subprime Auto Lending

Looking ahead, the subprime auto lending industry is poised for growth. Advances in technology, such as AI-driven credit scoring models, are likely to enhance lending practices and improve borrower outcomes. Additionally, increasing consumer awareness and regulatory oversight will continue to shape the industry's evolution.

Innovations in Subprime Lending

Emerging innovations, such as blockchain-based loan platforms, could revolutionize the subprime lending landscape by enhancing security and transparency. These advancements hold promise for a more equitable and efficient financial system.

Conclusion

Subprime auto lending plays a vital role in the automotive finance industry, providing opportunities for individuals with poor credit to secure vehicle loans. While it comes with inherent risks, understanding its mechanics and adhering to best practices can help borrowers and lenders achieve positive outcomes.

We encourage readers to explore additional resources, such as the Federal Reserve and CFPB websites, to deepen their knowledge of subprime lending. Your feedback and questions are welcome in the comments section below. Additionally, consider sharing this article with others who may benefit from its insights.